Overview:Value Creation for Private Equity and Portfolio

As Private Equity and Investment Fund firms focus on value creation through an intelligent investment strategy and operations optimizations and transformations, Sphere provides a range of offerings spanning across the Pre-investment, Post-investment, and Exit stages.

We aim to insure alignment with investment criterias and reduce risk with our tech due diligence offerings, and propel increased valuations by optimizing cost through Sphere cost optimization solutions and increase topline through our Digital Solutions, including our offerings across Cloud, Product Engineering, Artificial Intelligence and Data and Analytics

Solutions Tailored Specifically for Every Field

Private equity consulting services delivered to medium to large-scale businesses and institutions.

Solutions

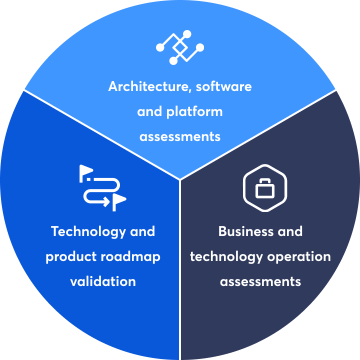

There’s a lot at stake when assessing and acquiring a company – and proper private equity services require a deep understanding of technologies, operations and specific industry processes.

Our team provides independent, commercially-focused assessments of a target or vendor’s technology platforms, products and operations, giving you the confidence to close the deal.

Why Sphere

With expertise spanning across various sectors including M&A firms, private equity, healthcare, e-mobility, banking, financial services, venture capital firms, and family offices, we provide swift technology and software assessments in four weeks or less.

Sphere team has successfully assisted leading investment banks, asset management and wealth management firms within private equity services by adopting transformative technologies such as digital, AI, and cloud to gain a competitive edge and achieve new business outcomes.

Meet Our Team

For more than 20 years, we’ve been at the forefront of technological advancement, empowering our clients and team to excel. Our board of tech leaders have collaborated with industry giants like HP, Google, AON, BP, Meta, and Lemonade, bringing unparalleled expertise to the table.

We’ve also partnered with major financial businesses, as well as with leading companies in mobility, transportation, insurtech, and fintech. These collaborations have enabled them to rapidly scale and innovate through the Private Equity Services Field.

Cases

START WITH AN INTRODUCTORY WORKSHOP